민스키 모델 Minsky Moment NEOgram/Issue2021. 2. 26. 23:06

민스키 모델이라는 것이 무엇인지 알아보자.

차근차근 나를 위한 공부 시작!!!

https://n.news.naver.com/article/024/0000067397

달라진 주린이들…민스키 모델 엘리엇 파동은 기본

“삼성전자 주가 민스키 모델 결과 보고 가라.” “현재 엘리엇 파동을 보고 있는데요, 박셀바이오 3차 파동이 곧 올까요?” 증시 변동이 커질 때 시장에는 각종 예측 모델이 인기를 끈다. 과도

n.news.naver.com

https://n.news.naver.com/mnews/article/353/0000032919?sid=101

Fed 금리 인상 후폭풍…거품 심한 미 정크본드 가격 추락 가능성 크다

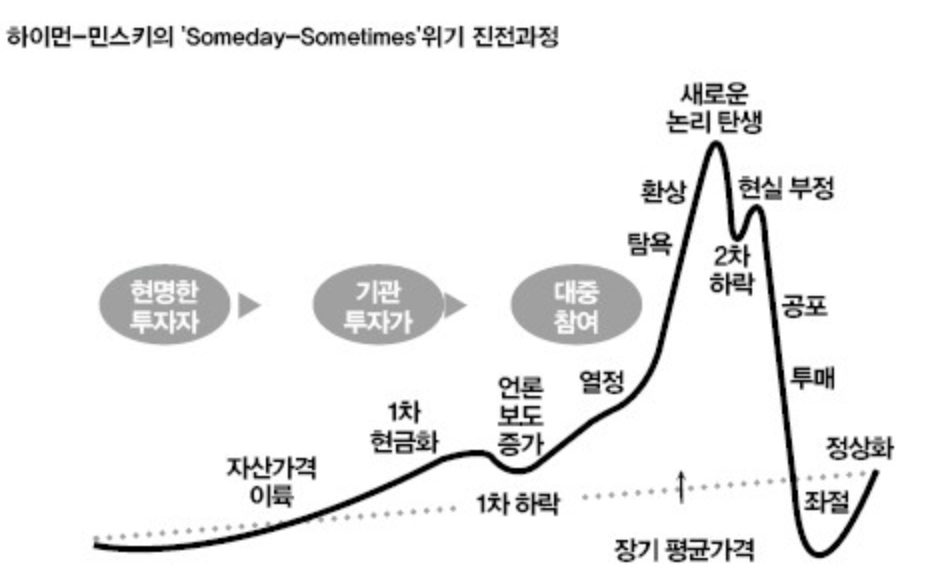

“세상은 오해 받을 리스크로 가득하다.” 미국 뉴욕주의 호프스트라대 장-폴 로드르게 교수(지리경제학)의 말이다. 자신이 개발한 금융버블 로드맵이 국내에선 ‘하이먼 민스키 모델’로 불리

n.news.naver.com

<시사금융용어> 민스키 모멘트(Minsky Moment) - 연합인포맥스 (einfomax.co.kr)

<시사금융용어> 민스키 모멘트(Minsky Moment) - 연합인포맥스

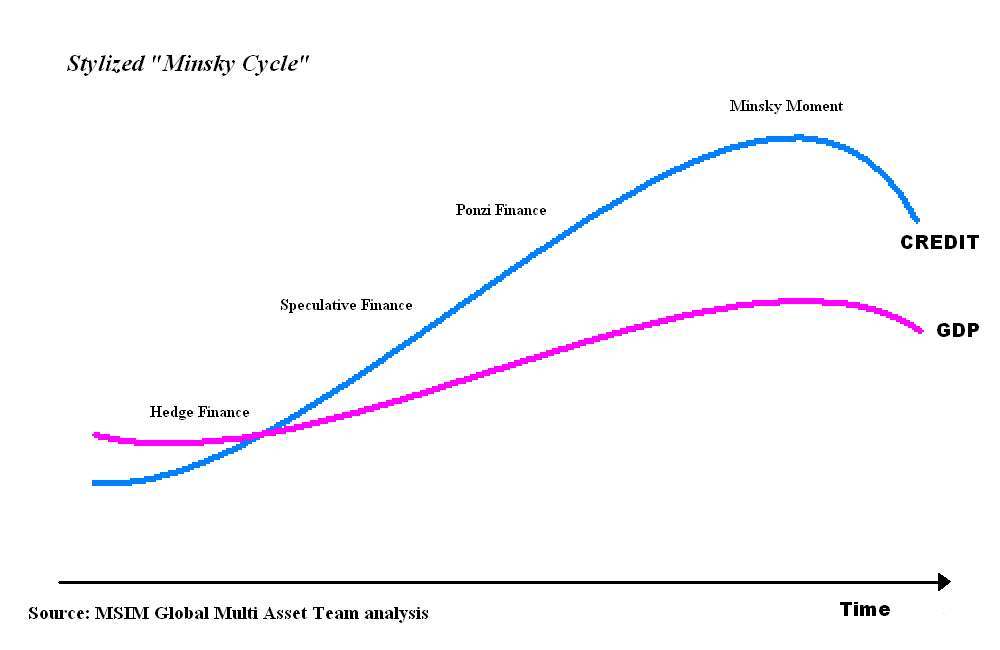

◆민스키 모멘트(Minsky Moment)란 과도한 부채로 인한 경기 호황이 끝나고, 채무자의 부채상환능력 악화로 건전한 자산까지 팔기 시작하면서 자산가치가 폭락하고 금융위기가 시작되는 시기를 의

news.einfomax.co.kr

◆민스키 모멘트(Minsky Moment)란 과도한 부채로 인한 경기 호황이 끝나고, 채무자의 부채상환능력 악화로 건전한 자산까지 팔기 시작하면서 자산가치가 폭락하고 금융위기가 시작되는 시기를 의미한다.

미국의 경제학자인 하이먼 민스키가 주장한 '금융 불안정성 가설(Financial Instability Hypothesis)'에 따른 이론이다. 그는 금융시장이 내재적으로 불안정성을 내포하고 있으며, 금융시장에서 활동하는 경제 주체들은 비합리적인 심리와 기대에 의해 크게 좌우되므로 자산가격과 거품과 붕괴를 주기적으로 겪게 된다는 내용이다.

민스키의 이론은 주류 경제학계에서 주목받지 못했으나 2008년 글로벌 금융위기 이후 재조명받고 있다.

민스키의 시나리오에 따르면, 시장 성장기에 경제주체들은 투자 리스크를 저평가해 위험자산으로 자금을 이동한다. 무리한 투자로 부채가 급증하는데 이는 금융시장의 규모 확대와 자산 가격 상승을 동반한다. 하지만, 실물경제와 괴리가 커지면서 투자 주체들이 기대했던 수익을 얻지 못하면 시장엔 불안 심리가 급속히 퍼지며 부채상환 우려도 증가한다. 불안에 금융시장이 긴축으로 돌아서면 이는 금리 급등과 자산가격은 급락으로 이어진다.

최근 중국 은행권의 부실채권 규모와 비중이 급증하면서 5년 안에 중국 경제의 경착륙이나 금융위기를 촉발하는 민스키 모멘트가 도래할 수 있다는 전망이 제기되고 있다.

경기둔화로 지난 2년간 중국의 은행권 부실채권은 두 배 가량 증가했다. 지난 2월 중국은행의 부실채권 규모는 1조4천억위안이다. 공상은행과 중국은행, 건설은행 등 중국의 주요 은행 순이익도 지난해 대비 0.1~0.5% 증가하는데 그쳐 10년 만에 최악의 성장률을 기록했다.

이에 중국 정부는 은행의 부실채권을 증권화해 시장에 매각하는 방안과 부실채권을 대출한 기업의 주식으로 바꾸는 방안 등 대책을 마련하고 있다. (정책금융부 강수지)

(서울=연합인포맥스)

하이먼 민스키 모델Hyman Minsky Model

Minsky moment - Wikipedia

From Wikipedia, the free encyclopedia Jump to navigation Jump to search Sudden collapse of asset values which generates a credit or business cycle Different phases leading to Minsky Moment A Minsky moment is a sudden, major collapse of asset values which m

en.wikipedia.org

Hyman Minsky - Wikipedia

Hyman Philip Minsky (September 23, 1919 – October 24, 1996) was an American economist, a professor of economics at Washington University in St. Louis, and a distinguished scholar at the Levy Economics Institute of Bard College. His research attempted to

en.wikipedia.org

https://steemkr.com/kr/@creamer7/jattf

가까이서 보면 비극이지만 멀리서 보면 희극이다. — Steemkr

안녕하세요! 크리머입니다 :) 지속되는 떡락장 속에 멘탈 유지 잘하고 계신가요? 저 역시 스팀잇을 보며 멘탈 유지를 하고 있습니다. 스티미언 여러분들은 블록체인/크립토커런시의 혜택을 미리

steemkr.com

Minsky Moments in IT. From my time machine — August 20, 2007 | by Paula Paul | technowoman | Medium

Minsky Moments in IT

From my time machine — August 20, 2007

medium.com

Stability Breeds Instability - Fact or Myth? (factmyth.com)

Stability Breeds Instability - Fact or Myth?

Stability isn't necessarily destabilizing, but as Hyman Minsky's Financial Instability Hypothesis eludes: long term stability breeds instability and diminishes resilience in economic markets, mainly due to psychological factors.

factmyth.com

Minsky’s Borrower Schema

As Wikipedia states clearly: “Minsky identified three types of borrowers that contribute to the accumulation of insolvent debt: hedge borrowers, speculative borrowers, and Ponzi borrowers.[6]

- The “hedge borrower” can make debt payments covering interest and principal from current cash flows from investments.

- For the “speculative borrower,” the cash flow from investments can service the debt, i.e., cover the interest due, but the borrower must regularly roll over, or re-borrow, the principal.

- The “Ponzi borrower” (named after Charles Ponzi, see also Ponzi scheme) borrows based on the belief that the appreciation of the value of the asset will be sufficient to refinance the debt. They cannot make payments on interest or principal with the cash flow from investments; only the appreciating asset value can keep the Ponzi borrower afloat.

If Ponzi-style finance is common enough in the financial system, then the inevitable disillusionment of the Ponzi borrower can cause the system to crash. When the bubble pops, and the asset prices stop increasing, the speculative borrower can no longer refinance or roll over the principal even if they can cover interest payments. As with a line of dominoes, a collapse of the speculative borrowers can then bring down even hedge borrowers, who are unable to find loans despite the apparent soundness of the underlying investments.”

In other words, a domino effect occurs where “irrationally exuberant” “Ponzi investors” crash the market, then take down semi-irrationally exuberant “speculative investors”, and then finally more rational “hedge investors” (and the whole market) generally come crashing down with them.

This is the mechanics of what happens, now lets move along to the psychological aspects of this to see how the growth before the crash led to the euphoria and “irrational exuberance” that fuels the borrowing the caused the crash and how this leads to a general lack of resilience in the market following the crash.

Minsky’s Five Steps to a Bubble

Although different authors define this differently, we can generally state the stages of a bubble as:[7]

- Displacement: A displacement occurs when investors get enamored by a new investment opportunity, such as new technologies or new low interest rates.

- Boom: Prices rise slowly at first, but then gain momentum as more and more participants enter the market. As excitement grows prices continue to rise, the investment begins to get media coverage and cause general euphoria.

- Euphoria: As excitement turns to mania people begin to invest based on emotion rather than reasonable metrics. The “greater fool” theory (that the price of an object is determined not by its intrinsic value, but rather by irrational beliefs and expectations of market participants) plays out everywhere.

- Profit Taking: In this stage reasonable investors notice that assets are overvalued and begin to cash out.

- Panic: In the panic stage, prices start to fall and sellers exceed buyers. As supply overwhelms demand, asset prices slide sharply.

Summary

When things go well, people take more risks. In economics “they hold more debt” and “take more credit” in the hope of short-term profits. This drives the prices of high-risk assets up more than lower-risk assets. When this happens for long enough, the market loses its ability to bounce back, which we call “losing resilience.” Several factors join to lead to a bursting bubble. The accumulation of debt rides on an assumption that trends will not end or reverse themselves. This feeling becomes mixed with a market that lacks resilience. Stakes are raised higher and higher. When a downturn comes, the dominoes fall as properly valued and overvalued assets both fall in a chain reaction. See hedge borrowers, speculative borrowers, and Ponzi borrowers below. This may lead to a full-blown recession or depression. Disaster may be staved off with “a visible hand,” which can help save assets and return “confidence” to the market.

The Lessons

The details are complex, but the concept is simple and so are the lessons we can learn:

- We need to factor in social factors like euphoria into any socioeconomic theory.

- We need to factor in credit, debt, and instability when looking at socioeconomic models.

- We need to regulate private entities who would otherwise take risky bets that risk significant socio-economic destabilization for short-term gain, whether we mean a political bet, an economic bet, or other.

- And most importantly, things don’t work well in extremes.

In other words, the spirit of the laws should be one that enforces moderation, avoids extremes, and factors in both the good and bad times.

'NEOgram > Issue' 카테고리의 다른 글

| 문재인 대통령 아스트라제네카 접종 (0) | 2021.03.23 |

|---|---|

| 메타버스 (0) | 2021.03.03 |

| 로지시스 (0) | 2021.02.24 |

| ‘쿠팡’ 대박 예고한 손정의 "다음 투자처는 바이오""- 헤럴드경제 (0) | 2021.02.24 |

| 루시드모터스 (0) | 2021.02.24 |